Fujifilm is expected to make a stock and cash offer to Xerox that would give the Japanese group a 51 percent stake in the combined company, said a person with direct knowledge of the transaction terms.

A deal, which could be announced today will value Xerox at $8 billion, which was the market value of Xerox at the close of trading on Tuesday.

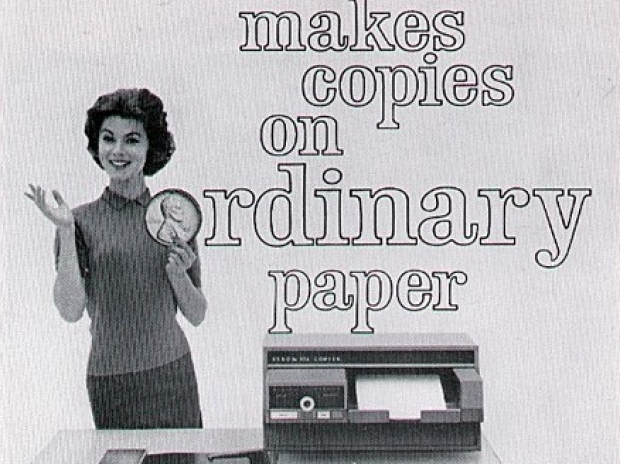

Ties between the two companies date back to the early 1960s when they formed a copier joint venture, which has grown to generate almost half of the Japanese group’s total annual revenues of $21 billion.

However some analysts questioned the merit of Fujifilm investing further in Xerox’s business, which has suffered a 15 percent decline in annual revenue to $10 billion over the past three years. Such a deal would break with the Japanese company’s strategy of branching into new areas such as pharmaceuticals and cosmetics to cushion the decline of its photo film sales.

Fujifilm said it would cut 10,000 jobs globally at its joint venture with Xerox, representing about 22 percent of its workforce at FujiXerox. It also lowered its full year operating profit guidance by 30 percent to reflect related restructuring charges. The Japanese company is scheduled to hold a news conference on its business strategy tonight.