Soon after buying out all his shareholders and going private, Dell wrote a cheque for EMC and created a considerable computer outfit. But word on the street is that despite a big debt load caused by all these buy-outs, Dell wants to expand further.

The word on the Street is that Dell’s board of directors will meet later this month to consider the most significant shakeup in the company’s history since it acquired data storage provider EMC for $67 billion in 2016, the sources said.

Dell is under pressure to boost its profitability after the EMC deal failed to deliver the cost savings and performance it projected, while higher component costs and a challenging data storage market have eroded its margins.

Dell is reviewing a list of several possible acquisition targets that would boost its cash flow and expand its offerings. Dell is also considering a sale or initial public offering (IPO) of its one of its fast-growing divisions, Pivotal Software. It may consider a transaction with its majority-owned VMware which have gained more than 62 percent in the past year.

Dell also has a security unit, RSA, and a cloud platform called Boomi which could receive the IPO treatment. Another possibility is that the company could give itself an IPO.

A bright spot in Dell’s business has been its servers, helping its total net revenue growth to $56.7 billion in the nine months from $41.6 billion a year earlier. However, the company’s operating expenses soared from $10 billion to $17.3 billion, leading to an operating loss of $3 billion, up from a $1.6 billion operating loss a year ago.

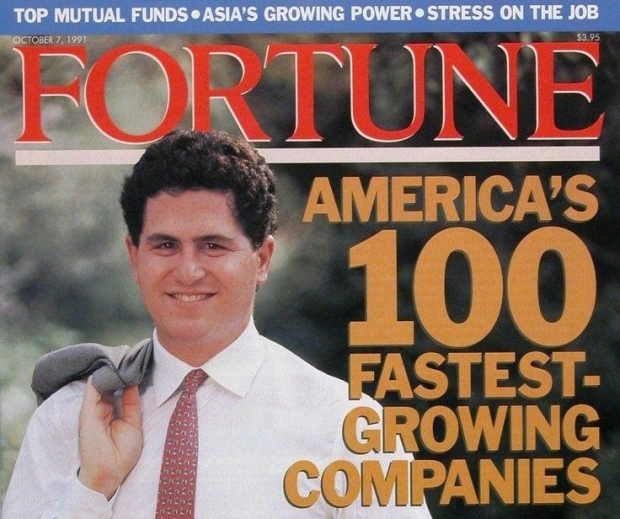

Private equity firm Silver Lake which helped bankroll Michael Dell’s $24.9 billion deal in 2013 to take the company private and owns about 18 percent of the company is believed to be wanting to cash out of the company.

A stock market listing for Dell would allow Silver Lake to gradually begin winding down its stake. What is more, an IPO of Dell, or divestiture of one or more of its assets, would help it pay down debt faster, saving it money on expensive interest payments, for which it currently pays about $2 billion annually.