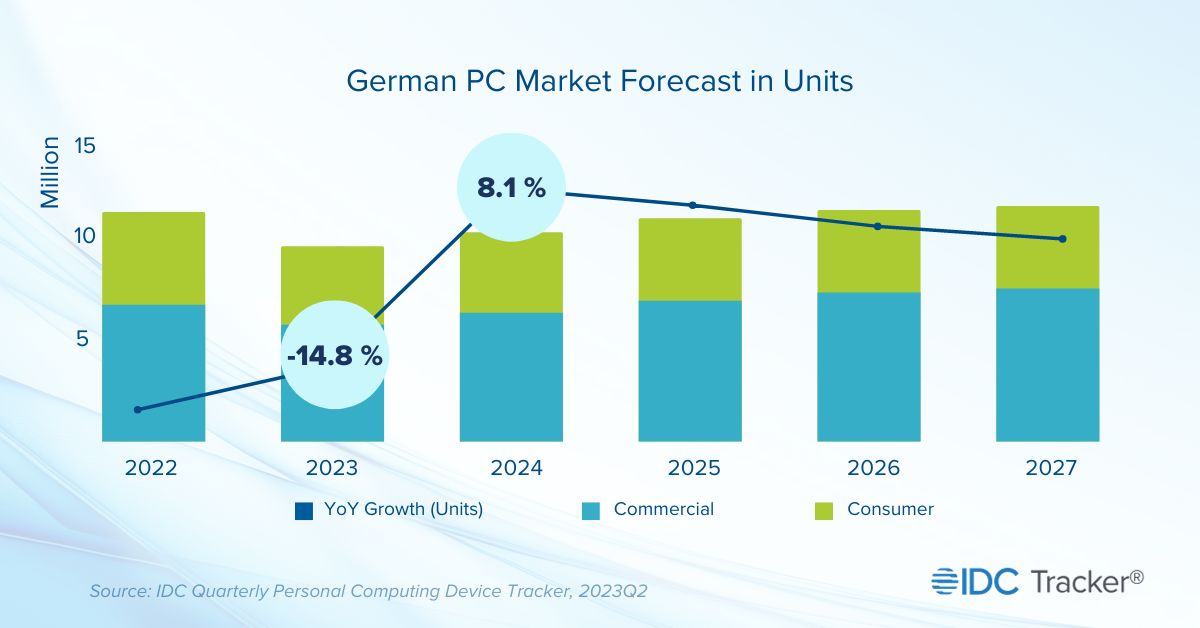

The outlook for the rest of the year remains bleak, with shipment volume forecast at 9.6 million units in 2023, a 14.8 per cent drop compared to last year, as vendors and distributors remain cautious in face of the German economic recession. However, IDC expects the PC shipment contraction in the second half of 2023 to be less severe than in the previous 12 months, as the basis for comparison is now lower.

IDC Senior research manager Malini Paul said the German PC market is expected to return to positive growth in the fourth quarter of 2023, after six consecutive quarters of year-on-year decline.

"The PC market recovery will continue in 2024 and beyond at a slow pace, thanks to an anticipated healthy inventory and a strong pipeline of deals".

IDC projects 8.1 per cent year-on-year growth for the German PC market in 2024, as shipment seasonality is expected to normalise after years characterised by a lockdown-induced boom-and-bust cycle. The supply chain constraints during the boom period led to a backlog, which has been deployed in the bust phase, resulting in large inventories.

Germany's market dynamics reflect that of the overall Western European (WE) region, where a sudden drop in demand led to aggressive pricing strategies and curtailment of shipments by vendors. IDC projects a year-on-year decline of 5.6 per cent in the WE PC market in Q3 2023 and a double-digit decline for the whole of 2023, IDC said.