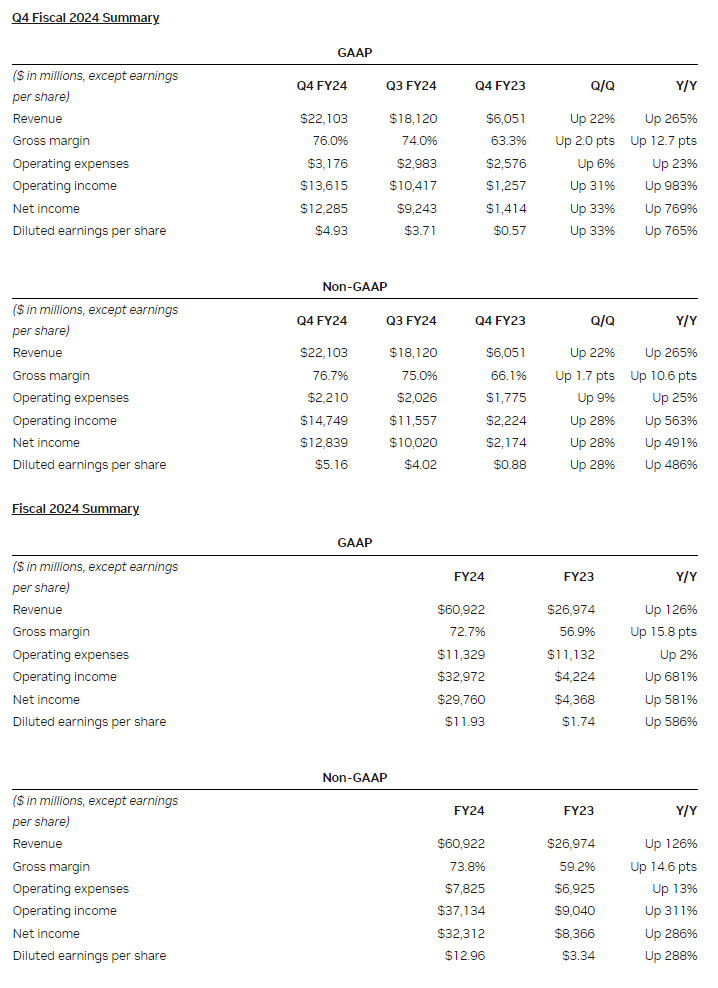

Nvidia shares soared by about 10 per cent after it reported fourth-quarter earnings that smashed Wall Street's predictions for profits and sales. The said revenue during the current quarter would be even better than expected, even against sky-high expectations for massive growth.

Nvidia's earnings per share was €4.79 adjusted versus the €4.31 the cocaine nose jobs of Wall Street expected. Revenue was €20.53 billion versus. €19.14 billion expected.

Nvidia said it expected €22.29 billion in sales in the current quarter. Analysts polled by LSEG were looking for €4.64 per share on €20.59 billion in sales.

Nvidia has been the primary winner of the recent technology industry craze, with huge artificial intelligence models developed on the company's pricey server graphics processors.

Nvidia boss Jensen Huang addressed investor fears that the company may not be able to keep up this growth or level of sales for the whole year on a call with analysts.

"Basically, the conditions are brilliant for continued growth" in 2025 and beyond, Huang told analysts.

He said demand for the company's GPUs will remain high due to generative AI and an industry-wide shift away from central processors to the accelerators that Nvidia makes.

Nvidia reported €11.41 billion in net income during the quarter, or €4.58 per share, up 769 per cent versus last year's €1.31 billion or 53 cents per share.

It said that Nvidia's total revenue rose 265 per cent from a year ago, based on strong sales for AI chips for servers, especially the company's "Hopper" chips such as the H100.

"Strong demand was driven by enterprise software and consumer internet applications, and multiple industry sectors including automotive, financial services and health care," the company said in commentary provided to investors.

Those sales are reported in the company's Data Center business, which now makes up most of Nvidia's revenue. Data centre sales were up 409 per cent to €17.09 billion. Over half the company's data centre sales went to large cloud providers.

Nvidia said its data centre revenue was hurt by recent U.S. restrictions on exporting advanced AI semiconductors to China.

"We understood what the restrictions are, reconfigured our products in a way that is not software hackable in any way, and that took some time, so we reset our product offering to China," Huang said.

"Now we're sampling to customers in China."

Nvidia Chief Financial Officer Colette Kress said that while the company had improved the supply of its AI GPUs, it still expected them to be in short supply, especially the next-generation chip, B100, which is scheduled to ship later this year.

"We are happy that supply of Hopper architecture products is improving," Kress said on a call with analysts. "Demand for Hopper remains very strong. We can expect our next-generation products to be supply-constrained as demand far exceeds supply."

"Whenever we have new products, as you know, it ramps from zero to a very large number, and you can't do that overnight," Huang said.

The company's gaming business, which includes graphics cards for laptops and PCs, was only up 56 per cent yearly to €2.66 billion. Graphics cards for gaming used to be Nvidia's main business before its AI chips started taking off, and some of Nvidia's graphics cards can be used for AI.

Nvidia's smaller businesses did not show the same rocketing growth. Its automotive business declined four per cent to €260 million in sales, and its OEM and other business, which includes crypto chips, rose seven per cent to €83.5 million. Nvidia's business making graphics hardware for professional applications rose 105 per cent to €429.5 million.