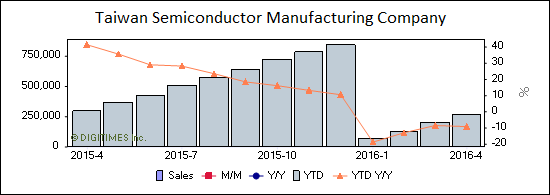

According to a recent post from Digitimes, the company’s net revenues for May 2016 were $2.29 billion USD ($NT 75.38 billion), an increase of 10.1 percent from last month and an increase of 4.9 percent from the same time one year ago. The company’s most recent revenue report can be found here.

TSMC year-over-year revenue graph, Q2 2015 to Q2 2016 (compiled by DigiTimes)

During an annual shareholders meeting, TSMC CEO Morris Chang stated that the company will maintain its target of 5 to 10 percent growth of consolidated revenues throughout the course of 2016.

Meanwhile, the most recent chart from Statista.com shows the top semiconductor companies from 2012 to 2015 by sales revenue, with Intel leading the pack followed by Samsung, TSMC, SK Hynix, Qualcomm and Micron.

![]()

Top semiconductor companies by revenue, 2012 to 2015 (via Statista.com)

An April report from IHS shows global semiconductor revenues fell by $7 billion (2 percent) in 2015 at total revenue of $347.3 billion for the whole year, down from $354.3 billion in 2014. This decline in revenue is a sharp contrast to the growth that occurred just two years beforehand, where the market saw 6.4 percent growth in 2013 and 8.3 percent growth in 2014. The IHS worldwide revenue ranking in 2015 from the top down lists Intel first, followed by Samsung, SK Hynix, Qualcomm and Micron - yet somehow forgets to list TSMC.

In 2015, less than 42 percent of 285 companies tracked by HIS were able to achieve revenue growth. These markets included memory ICs, logic ICs, analog ICs, discrete components, microcomponents, optical components, and sensors. On the other hand, the few segments that were able to manage growth last year included wireless communications ASICs and analog ASICs (30 percent each), radio-frequency (RF) small signal transistors wired communications logic ASICs and wireless communications ASSPs (10 to 20 percent each).

IHS predicts that overall growth in the semiconductor industry might be 2.1 percent compounded annually until 2020, but that it will be at least another six years before the market enables a “significant level of growth” in overall market revenues.